How to Link Aadhaar Card with EPF/UAN Account: It may be simpler for you to transfer or withdraw your employee provident fund (EPF) balance after you quit your work if your Aadhaar number is linked to your account.Employees may now link their PF accounts to Aadhaar extremely easily according to EPFO.

Your EPF account can be linked to Aadhaar using online and offline ways.

How to Link Aadhaar Number with EPF Account Online?

You can link your Aadhaar and PF account by following these five simple steps

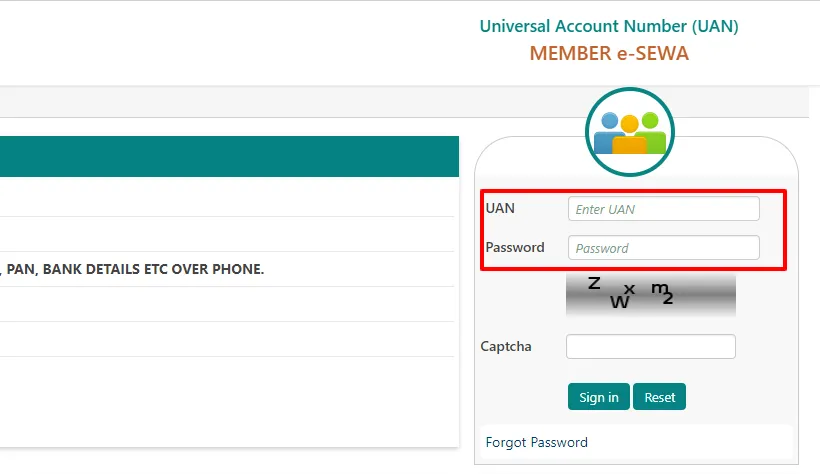

Step 1: Visit EPFO Member e-SEWA: https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Log in with your UAN number and password.

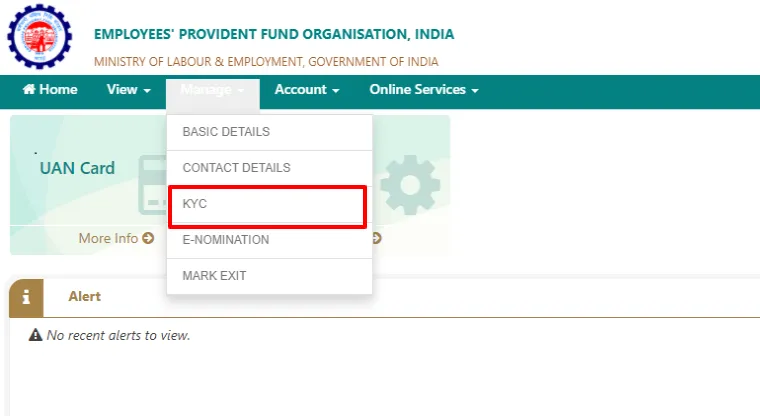

Step 3: Click on the ‘KYC‘ option under the ‘Manage‘ tab.

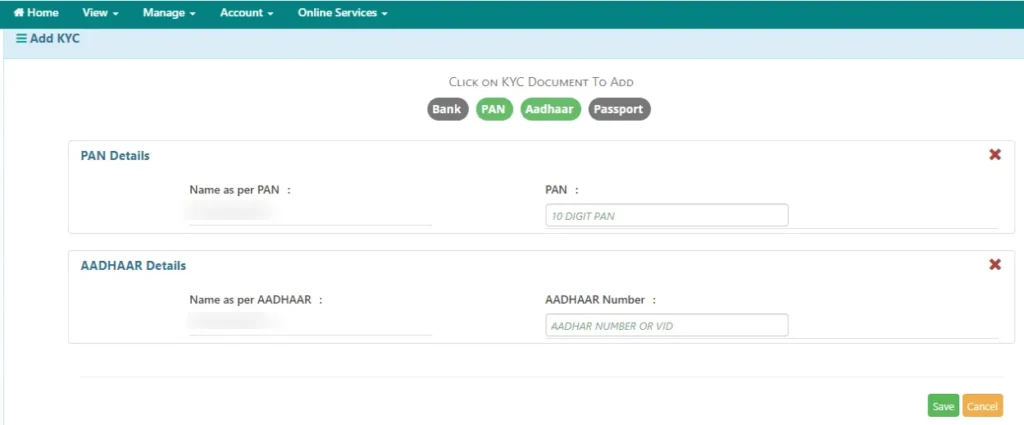

Step 4: Select the “Add KYC” link on the new page, enter your PAN and Aadhaar number, and then click “Submit.”

Step 5: After that, the information will show up on the “Pending KYC tab.”

After confirmation of the connection, your Aadhaar details will appear under the ‘Approved KYC’ tab.

How to Link Aadhaar Number with EPF Account Offline?

By going to the closest EPFO office, you can offline link your Aadhaar and PF account. You must submit an application that is properly completed by following these three easy steps.

- Step 1: Type your name, Aadhaar number, and UAN number into the columns.

- Step 2: Complete any additional pertinent fields as needed.

- Step 3: Send in the form and copies of your Aadhar, UAN, and PAN cards.

Once the given details are confirmed, your Aadhaar will be updated to your UAN, and you will receive a notification on your registered mobile number regarding this.

How to link EPF through Umang app?

The actions you need to do in order to link your EPF with the Umang App are listed below:

- Step 1: Use the MPIN or OTP option to log into your Umang app.

- Step 2: Click on “EPFO” under the “All Services Tab” after logging in.

- Step 3: Select “Aadhaar Seeding” from the list of eKYC services.

- Step 4: Click “Get OTP” after entering your UAN.A One-Time Password (OTP) will be sent to the registered mobile number.

- Step 5: Provide your Aadhaar details. Step 6: Your registered email address and mobile number will once more receive an OTP.

- Step 7: Make an OTP entry. Your UAN will be connected to your Aadhaar once it has been confirmed. When the link is accepted, your Aadhaar details will appear.

Following approval of the connection, your Aadhaar details will appear under the ‘Approved KYC’ tab.

Benefits of Linking Aadhaar with EPF Account

With over 4 crore subscribers, the Employee Provident Fund Organization has asked its users to link their EPF account with Aadhaar in order to facilitate simple detail verification.

A few advantages of connecting your Aadhaar number to your EPF account are listed below:

- Since your information is consistent with the details on your Aadhaar card, there are very few opportunities for errors and conflicts in the data when you link your Aadhaar with your EPF and UAN.

- Having a duplicate account is less likely when Aadhaar is linked to your EPF account.

- Online PF withdrawals are possible without your employer’s attesting to them. There is no trouble in completing the entire process online.